Exposing the False Claims Against Zelle®: The Political Misinformation Driving the Lawsuit Against Zelle

Resources

Click to view and/or download:

Jump to section:

Why Millions Rely on Zelle®

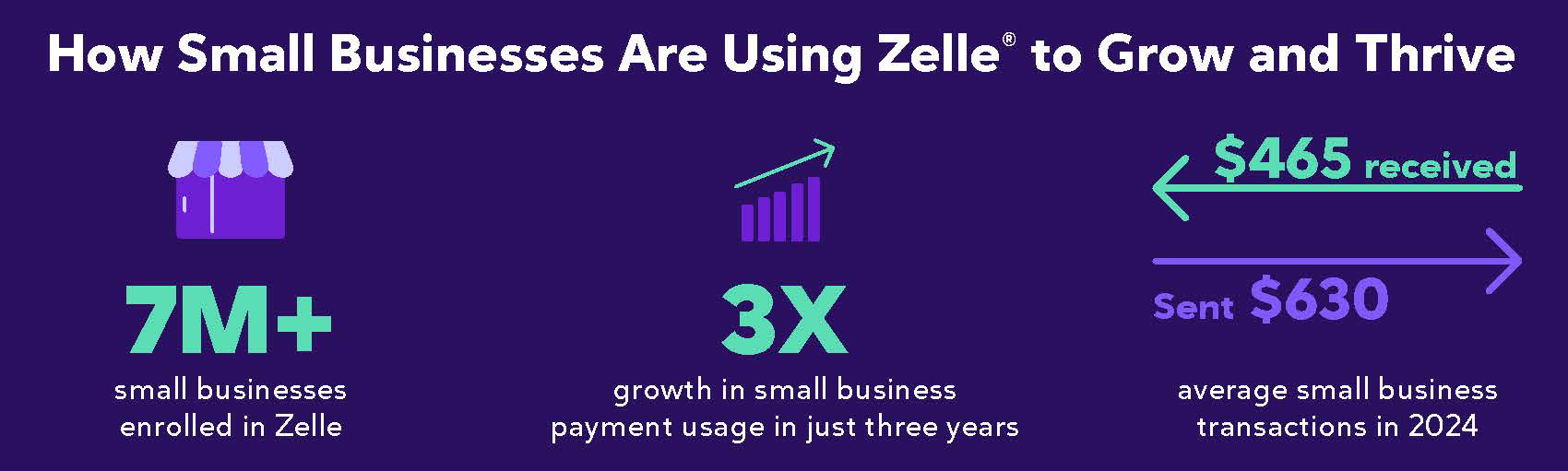

- Over $1 trillion was sent using Zelle in the U.S. last year by consumers and small businesses seeking secure, embedded payment experiences. Zelle is secure because you don't have to provide bank account information like other peer-to-peer apps.

- Zelle operates within a regulated banking environment, ensuring user protection and compliance with the same bank-level protections you get from your banking app today.

- Designed to support the needs of New York’s consumers, small businesses, community banks and credit unions.

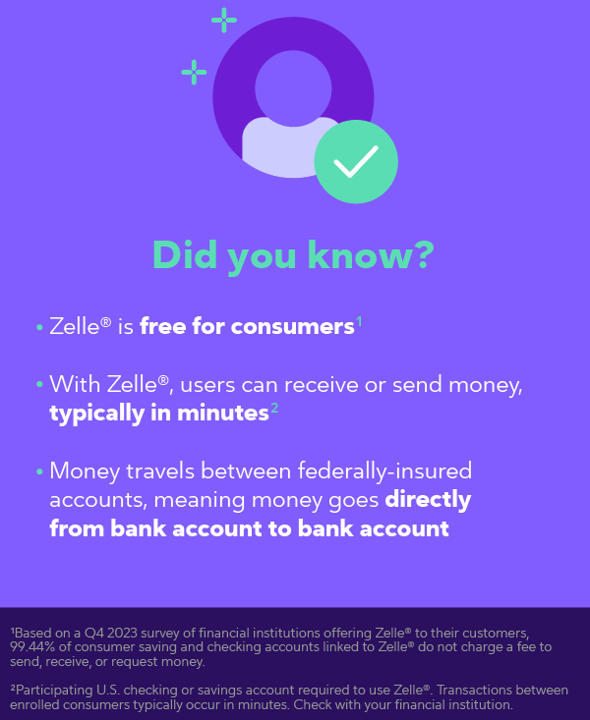

- Enables fast, easy and free payments for millions of consumers in New York and nationwide to send and receive payments easily and for free.*

Addressing the New York Attorney General’s Lawsuit

- The New York Attorney General’s lawsuit is a politically motivated stunt, mirroring a CFPB suit that was already dismissed in March.

- This legal action won’t stop fraud. It could encourage false claims from criminals that are seeking to game the system and create a blueprint for criminals to exploit.

- Rather than protect consumers, the lawsuit increases fraud risk and could drive up costs for everyone.

Zelle® Leads in Fighting Fraud & Scams

- Today, more than 99.95% of Zelle transactions are completed without any report of fraud or scams.

- Zelle continues to invest in security features, fraud education, and consumer fraud and scam protections.

- Zelle works closely with partner banks and credit unions to detect and respond to suspicious activity in real-time.

Where Fraud Really Happens & Why the Lawsuit Misses the Mark

- Scams don’t originate on Zelle®. They start with criminals contacting users via social media, email, phone calls, texts, and online marketplaces.

- The lawsuit ignores the root of the problem: organized domestic and foreign fraud networks targeting U.S. consumers.

- Encouraging no-consequence reimbursement policies invites fraudulent claims and shifts costs to legitimate users.

Zelle is designed with consumer safety in mind. With less than 0.05% of transactions today involving any fraud report, Zelle continues to be a top choice for digital payments. This lawsuit doesn’t protect users—it undermines trust and empowers criminal fraudsters.

*Based on a Q4 2024 survey of financial institutions offering Zelle® to their customers, 99.36% of consumer saving and checking accounts linked to Zelle® do not charge a fee to send, receive, or request money.

What You Need to Know: What Leticia James Gets Wrong

While New York Attorney General Letitia James has made misleading and politically motivated claims about safety and fraud rates related to Zelle®, the facts tell a very different story. Zelle leads the industry in fraud prevention, and today more than 99.95% of transactions are completed without any report of scam or fraud.

- The $1 Billion Losses Claim Is False: the claim by Attorney General Letitia James that “users lost more than $1 billion” is false and misleading.

- It’s unclear how the AG’s office calculated this number, but it likely reflects reported fraud claims, not confirmed payments fraud. Not every reported fraud claim is actual payments fraud. Each claim is investigated, and in many cases, it is determined that no fraud occurred. Below are examples of situations where a customer reported fraud, but the investigation could have confirmed no fraudulent activity:

- A customer may mistakenly report a forgotten purchase as a fraudulent transaction.

- Criminals may try and exploit the network by purposefully filing false claims.

- There may be another joint account owner on the bank account who sent a payment.

- A customer may make a payment to a contractor who doesn’t adequately complete agreed upon work. The customer may then file a fraud claim, but this is not payments fraud.

- No Investigation Was Ever Conducted by the NY AG: Despite her public allegations, Attorney General Letitia James never conducted an investigation into Zelle. If she had, she would have seen that today over 99.95% of Zelle transactions are completed without any report of scam or fraud.

- Extremely Low Fraud Rates: Zelle has consistently maintained industry-leading safety metrics, with less than 0.1% of transactions reported as involving fraud or scams since launch in 2017. Today, more than 99.95% of all Zelle transactions are without report of scam or fraud.

- Consumer Protections Were Not “Just Added”: Contrary to claims, Zelle consumer protection measures did not start in 2023. The Zelle Network® has had layered fraud prevention protocols in place since day one, including advanced data-driven fraud detection.

- How Zelle Helps Protect Your Money: Zelle is a secure platform when used as designed with state-of-the-art technology to monitor, detect, and prevent fraud. Participating financial institutions and Early Warning Services, the company behind Zelle, use a multi-layered approach to help protect consumers across every transaction.

- Zelle Requires Reimbursements for Confirmed Fraud: Zelle goes above and beyond federal law (Reg E) by requiring financial institutions in the network to reimburse users 100% for confirmed fraud cases, as well as in eligible authorized imposter scams.

- Zelle Is Free* for Consumers and Good for the Economy: Offered generally at no cost to consumers, Zelle helps drive local economic activity and modernizes how Americans send money. Reliably, quickly, and through their trusted bank.

Despite misleading claims from Attorney General Letitia James, the data shows that Zelle maintains a reported fraud rate below 0.05%. As Zelle continues to evolve, it stays focused on protecting users, combating scams, and delivering secure, bank-integrated payments nationwide.

*Based on a Q4 2024 survey of financial institutions offering Zelle® to their customers, 99.36% of consumer saving and checking accounts linked to Zelle® do not charge a fee to send, receive, or request money.

What Could Happen if the New York AG Lawsuit Succeeds

If the lawsuit filed by New York Attorney General Letitia James succeeds, it could have serious unintended consequences for consumers, small businesses, and the thousands of financial institutions that power Zelle®. Rather than reducing fraud, this legal action risks encouraging scammers and undermining a critical payment platform relied on by millions. Understanding the real impact is critical to separating fact from fiction.

- Criminals Would Get a Blueprint for Guaranteed Payouts: If Attorney General Letitia James’ lawsuit succeeds, it would encourage scammers by guaranteeing reimbursements with no consequences, leading to a surge in fraud and scams. That would harm New Yorkers, not protect them. Criminals quickly adapt, and guaranteed payouts would open the floodgates to more scams, not less.

- Small Businesses Would Suffer: Many small business owners rely on Zelle to manage cash flow quickly and securely because they don’t have to provide their account information. The lawsuit would disrupt this critical tool, harming businesses’ ability to make timely decisions such as paying employees, purchasing supplies, or investing in growth. This would ultimately impact families and local economies.

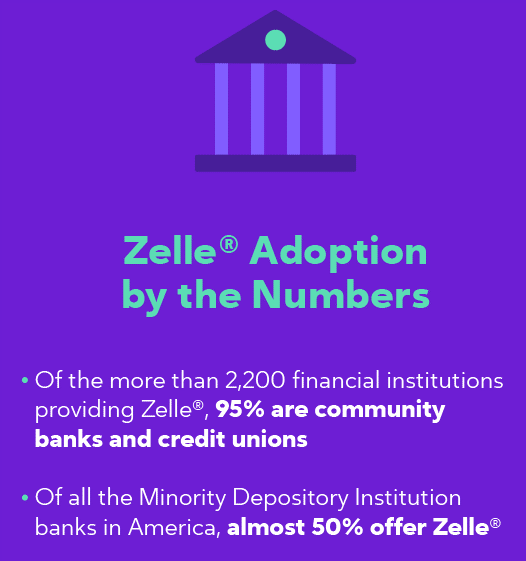

- Community Banks and Credit Unions Would Bear Unfair Costs: The lawsuit would shift the financial burden of fraud onto thousands of community banks and credit unions. Many of these institutions, including minority-owned banks and credit unions, already operate on thin margins. These institutions may be forced to either raise fees for consumers or stop offering Zelle services, reducing competition and consumer choice.

Ultimately, the lawsuit threatens to increase fraud risks, harm small businesses, and impose unfair costs on community banks and credit unions, many of which serve minority communities.

Where Fraud Really Begins and How to Stop It

Americans understand that the real solution isn’t chasing fraud after it happens—it’s stopping criminals before they ever get close to the money.

Fraud and scams begin much earlier than the payment method through deceptive tactics such as phone calls, texts, and online ads used by criminals to trick consumers. Effectively combating these threats requires cross-industry collaboration among government agencies, social media companies, telecom providers, and financial institutions – for example:

- Increasing resources for law enforcement to identify and prosecute wrongdoers and criminal penalties for the bad actors who are responsible for perpetrating fraud and scams.

- Requiring mobile network operators to fully block spoofed calls, which will stop bad actors from falsifying their identities on phone calls.

- As Attorney General Letitia James has also acknowledged, it's critical to hold social media companies accountable for scams on their platforms. She recently urged Meta to do more to protect Facebook users from fraudulent investment ads.

Key solutions include stronger law enforcement efforts, blocking spoofed calls by mobile operators, and social media platforms taking responsibility for stopping fraudulent content. Supporting bipartisan measures like the TRAPS Act can further empower a coordinated response to disrupt criminal networks and create a safer digital payments ecosystem for all.

Zelle® Is Helping Lead the Fight Against Fraud and Scams

Zelle and Early Warning Services are at the forefront of helping protect consumers and the financial system from fraud. With industry-leading tools, strong partnerships, and a proactive approach, Zelle continues to set the standard for security and scam prevention.

- Working together with law enforcement, Zelle and its partner banks and credit unions actively help identify and hold criminals accountable.

- Using cutting-edge fraud intelligence technology, Zelle doesn't just respond to fraud. It works to keep bad actors out entirely. Early Warning’s success is so strong, it's now advising the U.S. Treasury and Federal Reserve on fraud prevention for FedNow.

- Zelle empowers users with fraud education, delivering timely scam awareness messages to millions of users nationwide.

- Partnering with organizations like Consumer Action, Zelle is conducting nationwide fraud prevention workshops for local communities.

- Zelle plays a national leadership role, serving on the Aspen Institute's Task Force on Fraud and Scam Prevention to tackle fraud as a public safety and economic threat.

Even with fraud and scam rates already extremely low, Zelle remains committed to driving industry-wide innovation in consumer protection and scam prevention.

Nothing will change that.